亚马逊又出事了! 温馨提醒(不是打广告):已经注册了VAT的亚马逊卖家们、赶紧把VAT号码上传亚马逊后台、没有VAT的FBA卖家要赶紧申请。刚刚客户收到亚马逊的邮件、直接账号限制了。 另外,小编附上邮...

亚马逊又出事了!

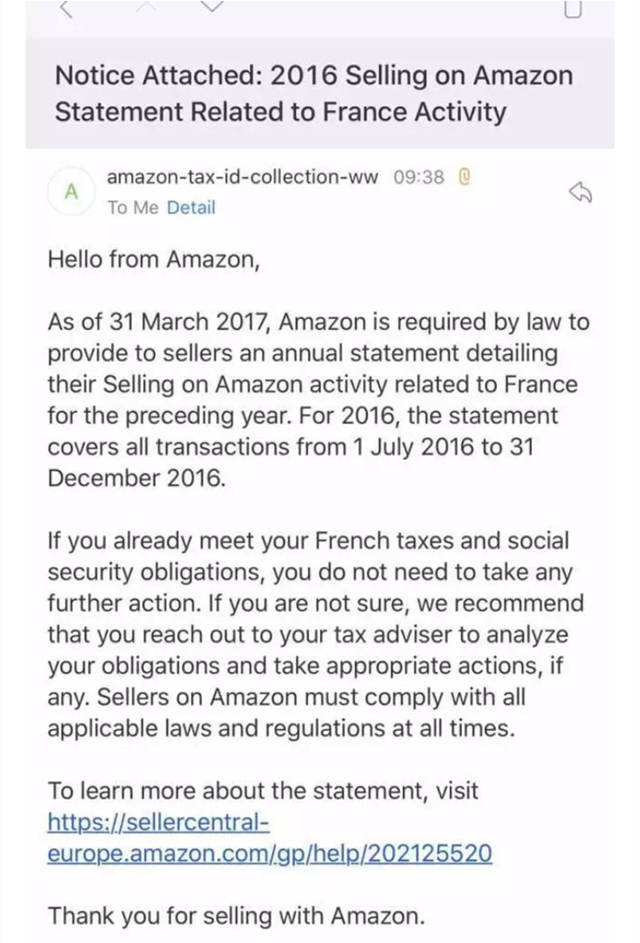

温馨提醒(不是打广告):已经注册了VAT的亚马逊卖家们、赶紧把VAT号码上传亚马逊后台、没有VAT的FBA卖家要赶紧申请。刚刚客户收到亚马逊的邮件、直接账号限制了。

另外,小编附上邮件亚马逊邮件一封。

Hello,

We received a notice from the UK tax authority, Her Majesty’s Revenue and Customs (HMRC), indicating that you do not currently meet VAT requirements in the UK. Sellers on Amazon must comply with all applicable laws and regulations.

As a result, you may no longer sell on Amazon.co.uk and you are no longer allowed to use our Fulfilment by Amazon (FBA) service in connection with Amazon.co.uk.

Please ship any open orders and submit a request to remove any FBA inventory from our fulfilment centers in the UK (https://sellercentral-europe.amazon.com/gp/help/200280650). If you do not submit this request within the next 30 days, we may dispose of your inventory.

Additionally, you may no longer offer to ship items into the UK on any of Amazon’s European marketplaces. You may also no longer use our FBA service to ship items into the UK. Your shipping options have been restricted accordingly.

If you have funds in your Selling on Amazon payment account,they will be available after any amounts for A-to-z claimsor chargebacks on your orders have been deducted. This usually takes about 90 days, but funds may be held longer by

Amazon Payments Europe S.C.A.

Please contact HMRC at onlineselling.compliance@hmrc.gsi.gov.uk to resolve your VAT status. Once HMRC informs us that their notice has been withdrawn, we may allow you to sell on Amazon.co.uk again.

Please let us know when you resolved your VAT status with HMRC by emailing vatsubmit@amazon.com.

To learn more about UK VAT obligations for overseas sellers, visit the UK Government website (https://www.gov.uk/guidance/vat-overseas-businesses-using-an-online-marketplace-to-sell-goods-in-the-uk#overseas-seller).

For information on tax advisory firms with discounted rates for Amazon sellers, visit our VAT Resources help page (https://services.amazon.co.uk/services/fulfilment-by-amazon/vat-resources.html).

Sincerely,

Amazon Services Europe

以上内容属作者个人观点,不代表雨果网立场!